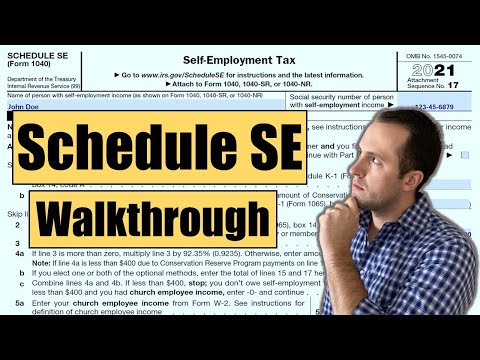

Hey everyone, I'm Bradford with the Painting Pendulum of Personal Finance. In this video, I'm going to walk you through how to fill out IRS Form 1040 Schedule SE, which is how you're going to calculate how much you owe in self-employment taxes. So let's jump into it! Here we have IRS Form 1040 Schedule SE for tax year 2021. Starting out, you're just going to enter your name as well as your social security number. Then we're going to jump into Part 1 for self-employment taxes. Now, the majority of people can skip Part A if they are not a member of the clergy or they work for a church. If you're not a farmer, you can also skip Parts 1A and 1B. If you are a farmer or a member of the clergy, please reference the instructions for this form, which I have linked in the description down below. For the vast majority of people, the first section they're going to care about filling in is going to be Part 2. In this situation, I'm going to say John Doe drove for Uber a little bit last year to make some extra money. Now, to keep things clean, I'm going to use some nice round numbers. So, where do you get the information for Part 2? You need to reference Schedule C, Line 31 if it's a sole proprietorship, or Schedule K1, which is part of Form 1065, Line 14 if you're a member of a general partnership or a multi-member LLC. Let's say John Doe made $3,000 for the previous year. Now, you're going to combine Lines 1A, 1B, and 2. If you didn't worry about these first two because you're not a farmer, you're just going to take whatever is in Line 2 and enter it into Line 3. Moving on to...

Award-winning PDF software

Video instructions and help with filling out and completing Form 1040-NR-EZ vs. Form 1040 Schedule Se